Forever 21’s U.S. Bankruptcy

Chapter 11 filing explained.

Forever 21, the once-dominant fast-fashion retailer, has filed for bankruptcy in the U.S. for the second time. On March 17, 2025, its U.S. operating company, F21 OpCo LLC, sought Chapter 11 protection, signaling the end of an era for the mall staple. But what led to this, and what does it mean for the brand’s future? Here’s a closer look at the history, financial struggles, and implications of this latest filing.

The Rise and Fall of a Fashion Empire

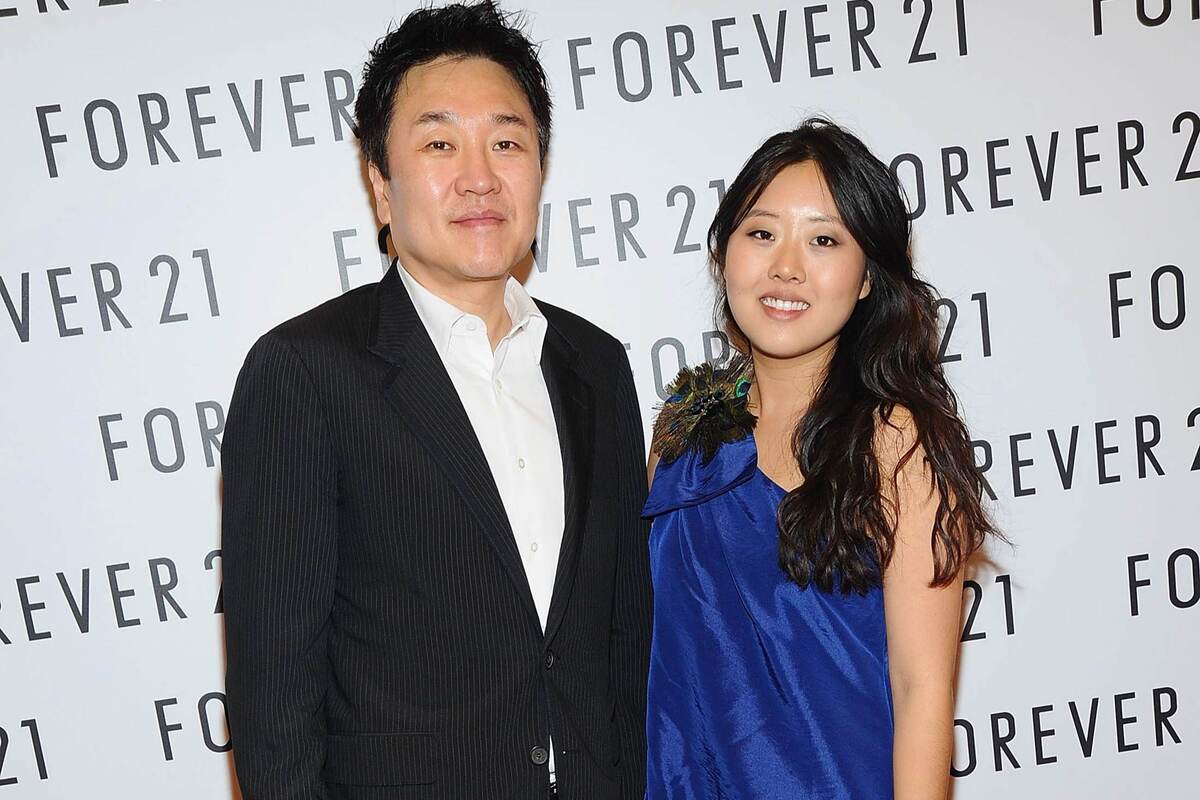

Founded in 1984 by Do Won and Jin Sook Chang, Forever 21 started as a small Los Angeles boutique called Fashion 21. It quickly expanded into a global powerhouse, known for trendy, affordable clothing aimed at young women. At its peak in 2019, the company had over 800 stores worldwide and brought in billions in revenue. However, shifting consumer habits, legal controversies, and the rise of e-commerce competitors like Shein and Temu began to erode its dominance.

The First Bankruptcy: A Warning Sign

In September 2019, Forever 21 filed for Chapter 11 bankruptcy due to mounting debts and declining mall traffic. The company shut down 350 stores globally and scaled back operations in several countries. A few months later, it was acquired for $81.1 million by Authentic Brands Group, Simon Property Group, and Brookfield Property Partners. Under new ownership, the company focused on e-commerce and licensing deals, but the fast-fashion landscape had already changed.

The 2025 Bankruptcy: A Final Chapter?

Despite previous restructuring efforts, Forever 21’s U.S. operations have struggled. The latest bankruptcy filing cites fierce competition, rising operational costs, and economic challenges. The company has been losing over $150 million annually and has decided to wind down all 354 of its remaining U.S. stores.

Here’s what’s happening now:

- Liquidation Sales: All stores will remain open temporarily to sell off inventory.

- Seeking a Buyer: Forever 21’s intellectual property may continue internationally through licensing deals.

- Impact on Employees: More than 9,200 workers face job uncertainty as the brand exits the U.S. market.

What’s Next for Forever 21?

While its U.S. presence is coming to an end, the Forever 21 name may live on. Authentic Brands Group, which owns the company’s intellectual property, could license it to international retailers. However, CEO Jamie Salter previously admitted that acquiring the brand was a mistake, raising questions about its long-term viability.

For shoppers, this marks the end of an iconic fast-fashion brand that once defined mall culture. For the retail industry, it’s yet another sign that brick-and-mortar stores must adapt or risk extinction.

As liquidation sales begin, customers may grab their final Forever 21 haul—before the brand fades into fashion history.