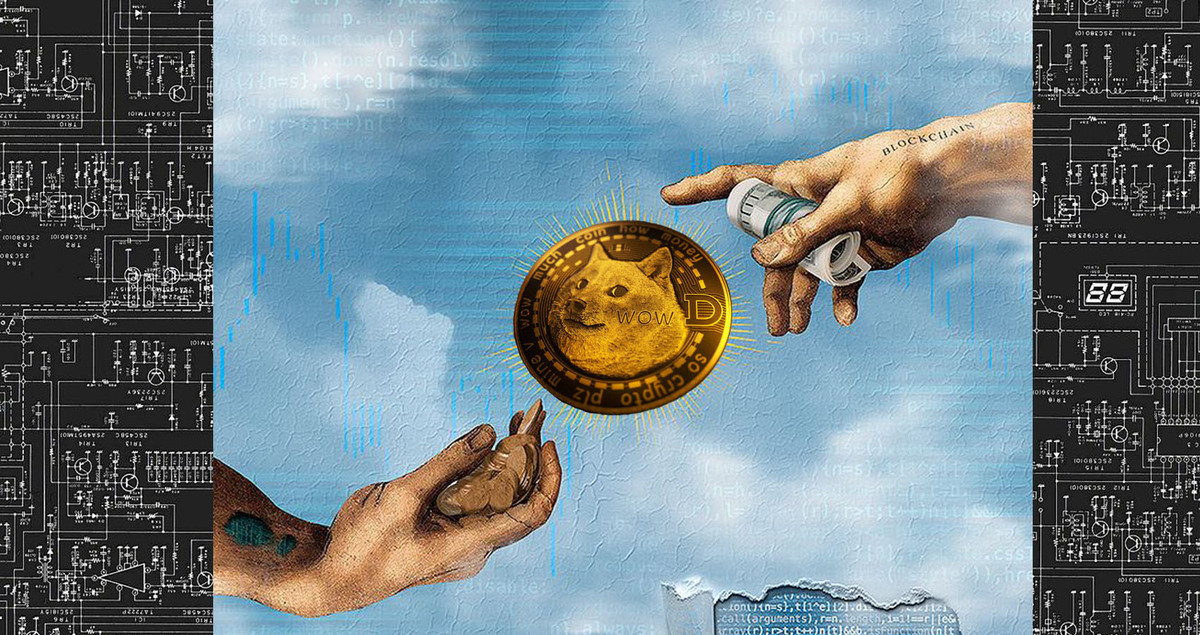

Analyzing Dogecoin’s Investment Potential

Explore Dogecoin's price trends, factors, and smart investment strategies.

Created by software engineers Billy Markus and Jackson Palmer, Dogecoin started as a joke in 2013. Inspired by the popular "Doge" meme, the cryptocurrency quickly gained a cult following, thanks in part to its playful nature and low transaction fees. Over time, Dogecoin evolved from being a meme coin to a serious contender in the cryptocurrency market, attracting a diverse group of investors, including retail traders and high-profile individuals like Elon Musk.

Why Are DOGE Price Predictions Essential?

For potential investors, understanding the trajectory of Dogecoin is crucial, particularly in the volatile world of cryptocurrencies. This is where DOGE USDT price prediction comes into play. Analysts and dedicated portals regularly provide price predictions for Dogecoin in relation to USDT (Tether), which is a stablecoin pegged to the U.S. dollar.

These predictions help investors gauge future trends and make informed decisions about their investments. The importance of these predictions lies in their ability to offer insights into potential price movements, helping investors manage risk and optimize their investment strategies. Tracking these predictions is essential.

Factors Influencing Dogecoin’s Price

Dogecoin's price is influenced by a variety of factors that potential investors should consider before making any investment decisions. Unlike traditional financial assets, cryptocurrencies are often subject to market sentiment, technological developments, and even social media trends.

Market Sentiment

Dogecoin’s price is heavily influenced by market sentiment, which can be both a boon and a risk for investors. The cryptocurrency community is known for its enthusiasm and loyalty, often driving prices higher during bullish phases. However, this also means that negative news or shifts in sentiment can lead to significant price drops. Key factors that impact market sentiment include:

- Social media influence: Tweets and endorsements from celebrities and influencers, particularly Elon Musk, have historically caused significant price movements.

- Market trends: General trends in the broader cryptocurrency market, such as bullish or bearish phases, often affect Dogecoin’s price.

- News and developments: Announcements of new partnerships, technological upgrades, or regulatory news can either positively or negatively impact sentiment.

Technological Developments

While Dogecoin was initially created without much technical ambition, its ongoing development is now a critical factor in its investment potential. The coin's developers are continually working to improve the network, making it more scalable and efficient. Key technological aspects include:

- Network upgrades: Enhancements to Dogecoin’s blockchain, including updates that improve transaction speed and reduce fees, can increase its attractiveness to investors.

- Integration with platforms: The adoption of Dogecoin by major payment platforms or its integration into popular financial apps can significantly boost its usability and, consequently, its price.

- Security enhancements: Continuous improvements in network security help to build investor confidence, reducing the likelihood of price drops due to security concerns.

Supply and Demand Dynamics

Dogecoin operates with an unlimited supply, unlike Bitcoin, which has a capped supply of 21 million coins. This factor plays a significant role in how Dogecoin’s price is determined in the market. Key points on supply and demand:

- Inflationary supply: With no maximum supply, Dogecoin’s inflationary nature can put downward pressure on prices over the long term.

- Increased adoption: If the demand for Dogecoin increases due to wider adoption or new use cases, it could offset the effects of its inflationary supply and drive prices higher.

- Market liquidity: The availability of Dogecoin on various exchanges ensures liquidity, which can either stabilize the price or make it more susceptible to market manipulation.

Potential Risks and Rewards of Investing in Dogecoin

As with any investment, Dogecoin comes with its own set of risks and rewards. Understanding these can help investors decide whether it aligns with their investment goals and risk tolerance.

Risks

- Volatility: Dogecoin is known for its price volatility, which can lead to significant losses in a short period.

- Speculative nature: Much of Dogecoin’s value is driven by speculation rather than intrinsic value, making it a riskier investment compared to more established cryptocurrencies.

- Regulatory risks: As with all cryptocurrencies, Dogecoin is subject to potential regulatory changes that could impact its price and usability.

Rewards

- High return potential: Dogecoin’s volatility, while a risk, also presents opportunities for substantial gains, especially during bull markets.

- Community support: The strong, active Dogecoin community often provides support and resilience, helping to stabilize the price during market downturns.

- Adoption growth: Increasing acceptance of Dogecoin for transactions and its integration into financial systems could lead to long-term price appreciation.

Strategies for Investing in Dogecoin

Investing in Dogecoin requires careful consideration and strategic planning. Here are some strategies that could help maximize potential returns while mitigating risks.

- Dollar-cost averaging (DCA): This strategy involves investing a fixed amount in Dogecoin at regular intervals, regardless of the price. It helps to spread out the risk and reduce the impact of volatility.

- Diversification: Avoid putting all your investment into Dogecoin. Diversifying your portfolio with other cryptocurrencies or traditional assets can help balance risk.

Conclusion: Is Dogecoin a Good Investment?

Dogecoin’s investment potential is both promising and challenging. While its volatility and speculative nature present significant risks, the strong community support, ongoing technological developments and growing adoption could offer substantial rewards.